When unexpected expenses arise, getting quick access to cash can be crucial. Our cash loan service allows you to get funds wired directly into your account within an hour, ensuring you have the financial support you need exactly when you need it. With a simple application process and fast approval times, our cash loans are designed to provide you with the peace of mind that comes from knowing help is just a click away. Whether it’s for medical bills, car repairs, or other urgent expenses, our cash loan service is here to support you in times of need.

What is a Cash Loan wired in One Hour?

Understanding the Process

A cash loan wired in one hour is a short-term financial solution designed to provide quick access to funds. The application process is streamlined to ensure that you receive the money in your account within 60 minutes of approval. This type of loan is ideal for emergencies such as medical bills, car repairs, or urgent home expenses. By simplifying the application and approval process, we make it possible for you to address your financial needs without the typical delays associated with traditional loans.

Benefits of Quick Cash Loans

- Speed: Funds are transferred within one hour, providing immediate financial relief.

- Convenience: The entire process can be completed online, eliminating the need for in-person visits.

- Accessibility: Our loans are available to individuals with various credit backgrounds, ensuring more people can access the funds they need.

- Flexibility: You can use the loan for any purpose, whether it’s for medical expenses, car repairs, or other urgent needs.

Learn more-: Moving loans in USA.

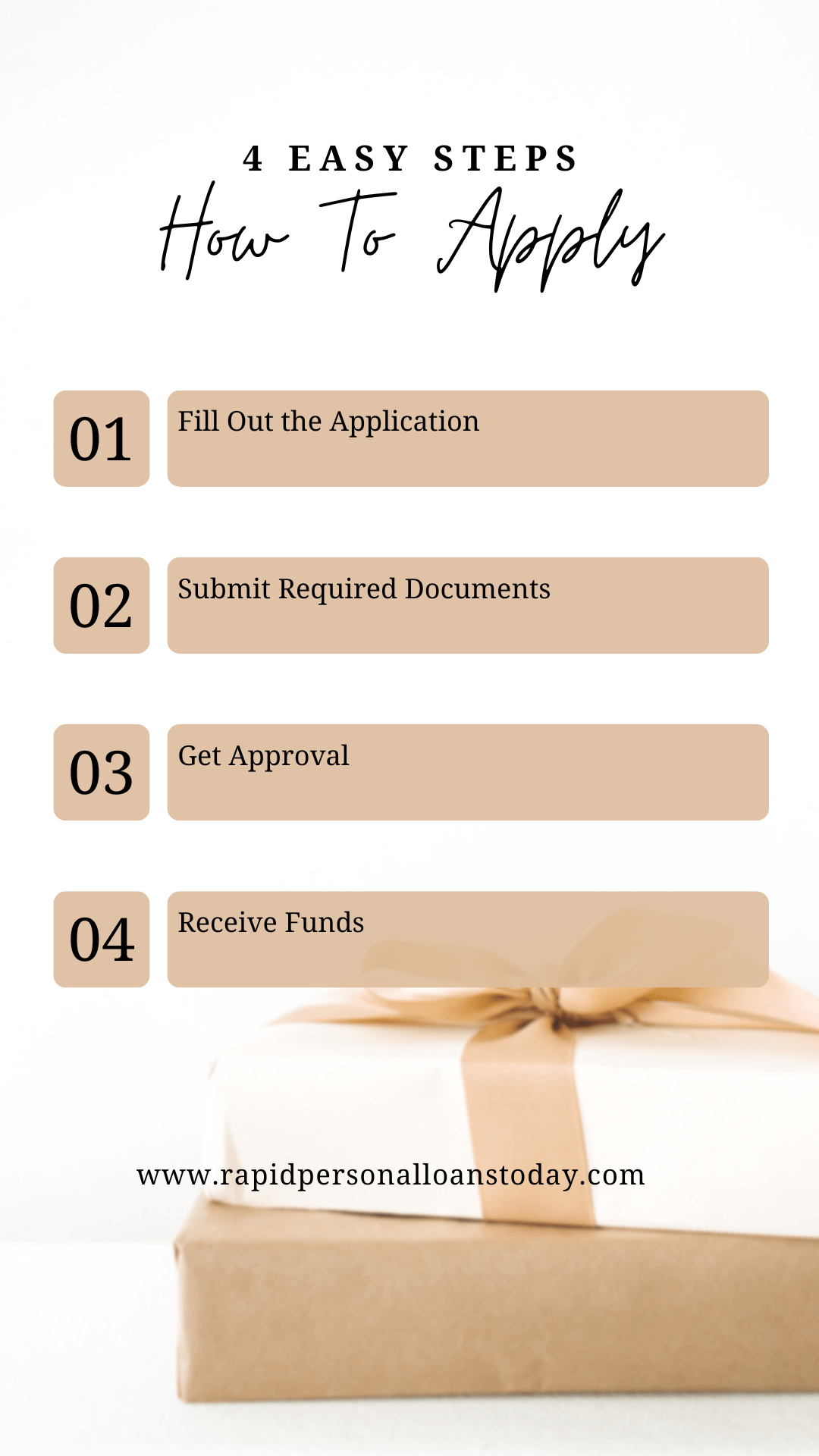

How to Apply for a Cash Loan Wired in One Hour?

Step-by-Step Application Guide

- Fill out the Application: Start by providing your personal details, employment information, and the loan amount needed. Our online application form is user-friendly and takes only a few minutes to complete.

- Submit Required Documents: Upload necessary documents such as ID proof, income verification, and bank details. This helps us verify your eligibility and process your loan quickly.

- Get Approval: Your application will be reviewed promptly, and you will receive approval within minutes. We prioritize speed to ensure you get the financial help you need without delay.

- Receive Funds: Once approved, the funds will be wired to your bank account within an hour. You can then use the money for any urgent expenses.

Required Documents and Information

To expedite the application process, please have the following documents ready:

- Valid ID: Driver’s license, passport, or other government-issued identification.

- Proof of Income: Recent pay stubs, bank statements, or other income verification.

- Bank Account Details: Information for the account where the funds will be deposited.

- Contact Information: Current address, phone number, and email address.

Having these documents prepared in advance will help ensure a smooth and quick application process.

Learn more-: Home repair loan in USA.

Eligibility Criteria for Cash Loans Wired in One Hour

Who Qualifies for Quick Cash Loans?

To qualify for a cash loan wired in one hour, applicants must meet the following criteria:

- Age: Must be at least 18 years old.

- Income: Have a regular source of income, such as employment, self-employment, or other verifiable earnings.

- Bank Account: Hold an active checking account to receive the funds.

- Residency: Must be a resident of the country where the loan is offered.

Meeting these basic criteria helps ensure that you can access the loan quickly and efficiently.

Tips for Improving Your Eligibility

To enhance your chances of being approved for a quick cash loan, consider the following tips:

- Maintain a Stable Income: Consistent earnings demonstrate your ability to repay the loan.

- Ensure Accurate Credit Reports: Regularly check your credit report for any errors and dispute inaccuracies.

- Pay off Outstanding Debts: Reducing existing debts can improve your credit score and eligibility.

- Prepare Documentation: Have all required documents ready to speed up the application process.

By following these tips, you can improve your eligibility and secure a cash loan more easily.

Interest Rates and Fees

What to Expect in Terms of Costs?

Interest rates for cash loans wired in one hour are typically higher than traditional loans due to the convenience and speed they offer. However, we ensure a transparent fee structure so you know exactly what you’re paying for, with no hidden charges. It’s important to review the terms and conditions carefully to understand the total cost of the loan, including interest rates and any additional fees.

Comparing Rates with Other Loan Types

When considering a cash loan wired in one hour, it’s helpful to compare it with other loan types:

- Payday Loans: These also offer quick funding but often come with higher interest rates and fees. They are usually due on your next payday.

- Personal Loans: Typically have lower interest rates but require more time for approval and disbursement.

- Credit Card Cash Advances: Provide immediate access to cash but usually have high interest rates and fees, which can add up quickly if not repaid promptly.

Understanding these comparisons can help you make an informed decision about which loan type best suits your needs.

Avoiding Scams and Fraud

Red Flags to Watch Out For

When seeking a cash loan wired in one hour, it’s crucial to be aware of potential scams. Look out for the following red flags:

- Unsolicited Loan Offers: Be cautious of offers received via email or phone without any prior inquiry.

- Upfront Fees: Legitimate lenders do not ask for fees before disbursing the loan.

- Lack of Clear Contact Information: Ensure the lender has a verifiable physical address and contact details.

- Guaranteed Approval: Be wary of promises for guaranteed approval regardless of your credit history.

Always research and verify the legitimacy of the lender before proceeding with an application.

How to Choose a Reputable Lender?

To ensure you’re working with a reputable lender, follow these guidelines:

- Check Reviews: Look for customer reviews and ratings on trusted websites to gauge the lender’s reliability.

- Verify Credentials: Confirm that the lender is registered and licensed to operate in your state.

- Read Terms Carefully: Thoroughly read the loan agreement and understand the terms before signing.

- Ask Questions: Contact the lender with any queries to assess their responsiveness and professionalism.

By following these steps, you can find a trustworthy lender and avoid falling victim to scams.

Learn More-: Personal Loan for Bad Credit.

Conclusion

Cash loans wired in one hour offer a fast and convenient solution for emergency financial needs. While the interest rates may be higher than traditional loans, the speed and ease of access make them a valuable option for those in urgent situations. Whether you need to cover unexpected medical bills, car repairs, or other emergencies, these loans provide the financial support you need quickly and efficiently. By understanding the process, eligibility criteria, and potential costs, you can make an informed decision about whether this type of loan is right for you. Remember to choose a reputable lender and read all terms and conditions carefully before proceeding.

Encouragement to Apply

If you’re facing an unexpected expense and need quick access to funds, consider applying for a cash loan wired in one hour. Our simple application process and fast approval can provide the financial relief you need when time is of the essence. Whether it’s for medical bills, car repairs, or other urgent needs, our service ensures that you receive the money swiftly and without hassle. Don’t let financial stress overwhelm you. Apply today and experience the convenience and support of Rapid Personal Loans Today.

FAQs About Cash Loans Wired in One Hour

Complete the online application, get approval, and receive funds within an hour. The process is designed to be fast and efficient, allowing you to access the money you need quickly for any emergency expenses.

To qualify for a cash loan wired in one hour, you must meet the following criteria:

- Age: Must be 18 years or older.

- Income: Have a regular source of income.

- Bank Account: An active checking account.

- Residency: Must be a resident of the country where the loan is offered.

Higher interest rates and fees are the main risks associated with cash loans wired in one hour. Ensure you can repay the loan on time to avoid additional charges and potential damage to your credit score.

You will need to provide the following documents:

- Valid ID: Driver’s license, passport, or other government-issued identification.

- Proof of Income: Recent pay stubs, bank statements, or other income verification.

- Bank Account Details: Information for the account where the funds will be deposited.

- Contact Information: Current address, phone number, and email address.

Loan amounts typically range from $100 to $5,000, depending on your eligibility and the lender’s policies.

Repayment is usually done via automatic withdrawal from your bank account on the due date specified in your loan agreement. Ensure you have sufficient funds in your account to avoid penalties.

Yes, you can get a cash loan with bad credit. However, the interest rates may be higher. Having a regular income can improve your chances of approval despite a low credit score.

If you can’t repay the loan on time, contact your lender immediately to discuss possible options such as an extension or a repayment plan. Communicating with your lender can help you avoid additional fees and negative impacts on your credit.

RapidPersonalLoansToday.com IS NOT A LENDER, we cannot ultimately decide whether or not you are approved for a loan. We also cannot determine or influence the amount of money you may receive from using our referral services. The operator of this web site will share the information you provide with participating lenders, advertisers, networks, and other partners who may or may not lend or issue credit. Providing your information on this web site does not guarantee that you will be chosen by a lender or approved for a loan. We do not act as agents, brokers, or representatives for any of our lenders, and we do not endorse or charge you for any service or product. All information that we collect and share about you is in accordance with our Privacy Policy which we advise you to review before submitting any information using our form. Because each lender is different and RapidPersonalLoansToday.com has no control over the rates and fees each lender charges, we urge you to carefully review the terms associated with the offer before accepting or declining. Please remember that you are never under any obligation to accept an offer from a lender, and you can cancel the entire process at any time at your discretion. RapidPersonalLoansToday.com cannot be held accountable for any charges or terms presented to you by a lender, and we are in no way responsible for any agreement between you and a lender. For details, questions, or concerns regarding your short-term loan, please contact your lender directly. Please note that lender terms may vary, and lenders may use different criteria to determine whether an applicant is eligible for a loan. Not all who submit a request for credit will be chosen by a lender or approved for loan. If you are not chosen by a lender in the participating lender network, your information may be offered to participating third party advertisers and generators for consideration. It is not our policy to perform credit checks on any of our customers. However, some of the lenders in our network might perform a credit check before making their decisions using the three major reporting bureaus like, TransUnion, Experian, and Equifax, as well as other alternate sources of consumer information. In the end, your credit rating may be impacted by a particular lender’s actions. If you do not pay back your loan by the specified due date, your lender may choose to report this delinquency to one or more of the major credit bureaus, which could negatively affect your rating. Any of the information that you read on this website may be changed at any time without any prior notice. We cannot guarantee that your submitted information will be provided to a lender or that a lender will approve you for a loan. Not all lenders can provide up to $1,500. The loans that may be offered by a lender are expensive forms of credit and are intended to provide you with short-term financing to solve immediate financial needs and should not be considered a long-term solution. If you are having serious financial issues, it is often best to consult with a professional credit counselor. Due to state regulations, this service is not available in all states including Arizona, New York, Georgia, Connecticut, Maryland, Massachusetts, Pennsylvania, Vermont, and West Virginia. For consumers in all other states, you are urged to visit the Rates & Fees section of this website to learn about the laws as they apply to loans where you live. In some cases, you may be given the option of obtaining a loan from a tribal lender. Lenders that are an extension of a federally recognized Indian Tribe are owned by independent sovereign nations and may not be required to follow local or state laws regarding rates, fees, and other loan terms, although such lenders conform to federal lending laws including the Truth in Lending Act. If you are connected to a tribal lender, please understand that the tribal lender’s rates and fees may be higher than state-licensed lenders. Additionally, tribal lenders may require you to agree to resolve any disputes in a tribal jurisdiction.